What is National Pension Scheme?

The National Pension Scheme is a voluntary retirement savings tool that helps citizens to secure the future through disciplined investing over the years. This helps ensure a regular source of income even after retirement.

Table of Contents

It is a fact that people can work efficiently, till a particular age only. But there always remains a requirement of money to sustain life, even after they stop working. Due to this, The Government of India introduced the National Pension Scheme with the objective of making lives easier and reducing dependency after retirement.

This long-term investment scheme is regulated by Pension Fund Regulatory and Development Authority( (PFRDA) and Central Government. In 2004, the Indian Government introduced this for government employees only but later in 2009 the option was open for the employees of the private sector as well. It allows a minimum contribution of ₹1000 annually. At retirement, people can either withdraw in a lump sum or choose a fixed pension for the rest of their lives.

NPS Investment Option

There are PFDRA appointed intermediaries, through which the subscribers can invest. These are trustee banks, PoP(Points of Presence), NPS Trust, Central Recordkeeping agency, Custodians, and Annuity Service Providers.

The subscribers have four options to distribute the percentage of their investment in:

- Equity or share market

- Corporate Bonds

- Government Bonds

- Alternate Investment Funds(AIFs

So, either they can decide this percentage themselves or get a personalized report from fund managers. Let’s look at both these NPS investment choices in more detail:

- Active Choice: If you opt for this option, you solely have the authority to decide what percentage you’re going to allot to each one of the above tools. If you’re in your early 30s you can take the risk in equity because the time period is longer for you. Whereas if someone is in their late 40s or 50s, they might want to have a bigger percentage in debt. The highest percentage restricted by the government for equity is 75% and for AIFs is 5%.

- Auto-Choice: If you do not want to critically analyze this percentage part of your investment, this is your option. The fund managers will do it for you. They will design custom reports keeping in mind your age and goals. That will determine the allocation of your investments, hence professional help is also an option.

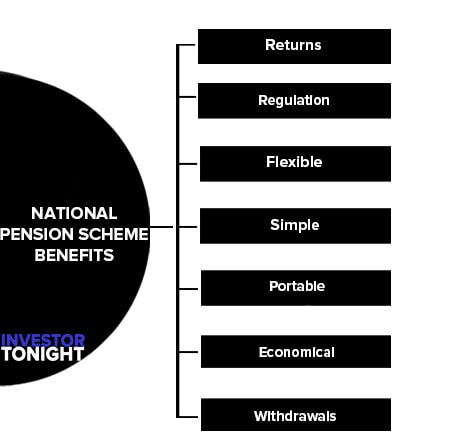

National Pension Scheme Benefits

There are numerous benefits of the National Pension Scheme. Some of them are listed here:

Returns

NPS offers four investment options to subscribers. One of them is equity which is not very safe. But in general, the interest rates offered under this scheme are much higher than other options available (like PPF).

Regulation

This scheme was introduced by the Government and is regulated by PFRDA, hence the investment options are comparatively safe. They follow transparent procedures and strictly adhere to the guidelines, so you know where your money exactly is.

Flexible

This model offers much flexibility in terms of investment. The option lies with the citizens and they can either choose the percentage of the amount to be invested in equity and debt or leave it to the managers.

Simple

Be it the opening of an NPS account or the investing, everything is simplified to the convenience of the public.

Portable

Even if you change your job, city or state, the NPS account and PRAN number remain unchanged. Tax Benefit Users can avail of a tax benefit for up to 2 lakhs. This scheme also falls under the Exempt-Exempt- Exempt (EEE) category. That means the accumulated amount, interest and withdrawal is non-taxable.

Economical

This is a very low-cost scheme and even the other associated charges like agent and agency costs are low.

Withdrawals

Although this investment is necessary till 60 years of age but in cases when a sum is required for serious illness or higher education of children, then there is a provision to withdraw 25% of your own investment after three years of account opening.

Eligibility for National Pension Scheme

- Any Indian citizen (including NRIs) within the age limit of 18-70 years is eligible to have only one NPS account under their name.

- The citizens should comply with the KYC norms to get themselves registered.

- There is no provision for Joint accounts and Hindu Undivided Family accounts in this model.

Types of NPS Account

There are two major types of accounts under National Pension Scheme:

Tier 1 Account

This is a default account that you get when you register for the National Pension Scheme. The minimum contribution has to be of ₹1000 per annum and withdrawals are not permitted here. Under sections, 80C and 80CCD users can avail of a tax benefit of up to ₹2 lakhs.

Tier 2 Account

This account is a voluntary investment account and can be opened upon the wish of the users with a minimum of ₹250 per contribution. The withdrawals are permitted here and a tax exemption of ₹1.5 lakhs is available only for central government employees. An important point to be noted here is, people having Tier 1 accounts can only opt for this one.

National Pension Scheme Tax Benefit

- Every individual subscriber of the National Pension Scheme is entitled to the tax benefit of ₹150,000 under section 80 CCE. An additional deduction on investment upto ₹50000 is also available for Tier 1 account holders.

- Moreover, the National Pension Scheme falls under the Exempt-Exempt-Exempt category which includes that the investment, interest and withdrawals are free of taxes.

How to Open a NPS Account

The NPS account can be opened in two modes:

How to open an NPS account offline?

- Step 1: To open an NPS account physically you have to look for a PoP or Point of Presence near you. You can search it up on NSDL official website just by entering your location.

- Step 2: Get yourself a registration and KYC form. Fill these documents with not less than an annual investment of ₹1000 and submit these to the PoP. There would also be a registration fee of ₹125 for the process. With this, they will generate your Permanent Retirement Account Number or PRAN.

- Step 3: You will receive this number and password in a sealed document. You’re all set to activate and operate your account.

How to open a NPS account online?

- Step 1: Online process can be done at the comfort of your home. Visit enps.nsdl.com if you have your AADHAAR card, PAN card and mobile number linked to your bank account.

- Step 2: Fill the required forms online and take the steps that the website requires. Confirm the transaction with the OTP you receive on your registered mobile number.

- Step 3: Your PRAN will be generated online itself and you can access your account with this.

Conclusion

Overall NPS is a great option to create a habit of investing and securing the post-retirement life simultaneously. You can start investing at an early age to maximize the benefits of this tool. Starting early has tons of advantages; you get maximum returns, you can experiment with riskier options that have higher returns, and you compound the investment greatly.

FAQ: National Pension Scheme

National Pension Scheme Lock-in Period?

There is a lock-in period of 3 years for government employees, on the other hand its nil for private-sector employees. Hence affecting the returns. The returns will highly depend on your allocation across debt and equity.

National Pension Scheme withdrawal?

At the time of retirement, the subscribers are allowed to withdraw 60 % of the amount. The rest 40% will be given as monthly pension during your lifetime. If the amount is needed before retirement, 25% can be withdrawn after 3 years only for genuine and serious reasons.