What are Debentures?

A debenture is a written acknowledgment of the debt by a company under its common seal, agreeing to repay the same after a specified period and to pay interest at regular intervals. It is a part of the ‘‘Loan Capital’’ of a company and is also known as borrowed capital.

Table of Contents

The Companies Act, 2013 has not defined the term ‘debenture’. It has simply stated in Section 2(30) that ‘‘Debenture includes debenture inventory, bonds and any other securities of a company whether constituting a charge on the company’s assets or not’’.

Various authors have defined debentures in terms of a document recognizing as debt.

Definition of Debentures

A debenture is a document given by a company as evidence of a debt to the holder usually arising out of a loan and most commonly secured by the charge.

Debenture means a document that either creates a debt or acknowledges it, and any document which fulfills either of these conditions is a debenture.

Features of Debentures

Following are the features of a debenture:

- It is an acknowledgement of debt or loan taken by a company.

- It is issued in the form of a certificate in written form to the lender.

- Its face value is predetermined.

- It is issued under the common seal of the company.

- Rate of interest payable on the debentures is stated on the certificate.

- It does not carry voting right like shares.

- The amount of debentures is repaid after a fixed period as per the terms of issue.

- These are generally secured by floating charge on the company’s assets.

- It may be fully convertible (FCD) or partly convertible (PCD) or nonconvertible (NCD) into equity or preference shares.

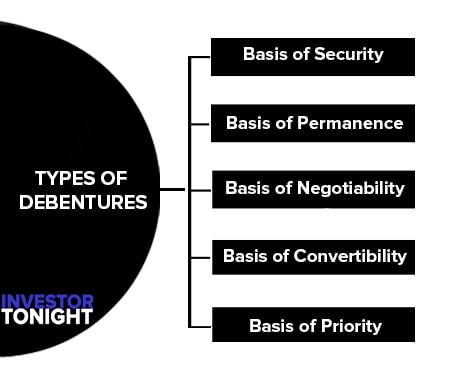

Types of Debentures

A company may issue different types of debentures. These can be classified as under:

Basis of Security

Naked or Simple Debentures

Naked or Simple Debentures are not backed by any security or guarantee either for payment of interest or for the repayment of the loan. Such debentures are not very popular among the public and hence they are not very common.

Mortgaged Debentures

Mortgaged Debentures are secured by a fixed or floating charge on the whole or part of the company’s assets. If required, the uncalled shares of the company may also be charged.

Basis of Permanence

Redeemable Debentures

Redeemable Debentures are those which are paid off by the company after a stipulated period during the existence of the company. Generally, at the time of issue, the terms of redemption are stated in the prospectus.

Irredeemable Debentures

Irredeemable debentures are not repayable so long as the company continues to be in existence. These debentures will be repaid only on the winding up of the company.

Basis of Negotiability

Registered Debentures

Registered Debentures are those debentures where the names of the holder of such debentures appear in the debenture certificates issued by the company. The names, addresses, and particulars of the debentures possessed by each of them are entered in the Register of Debentureholder.

Bearer Debentures

Bearer Debentures are unregistered debentures that are payable to the bearers or holders. They are negotiable/transferable by mere delivery. No record is kept by the company about the particulars of the holder of such debentures.

Basis of Convertibility

Convertible Debentures

Convertible Debentures are those debentures the holders of which are given the option to get the debentures held by them converted into shares or new debentures after a specified time as per the terms of issue.

Such debentures may be fully convertible, called ‘‘Fully Convertible Debentures’‘ (FCD) or partly convertible, called ‘‘Partly Convertible Debentures’’ (PCD). According to SEBI’s guidelines the debentures, if convertible, must be converted within 36 months of issue.

Non Convertible Bebentures

Non-Convertible (NCD) Debentures are those debentures the holders of which do not have the option to get the debentures held by them converted into shares or new debentures.

Basis of Priority

First Mortgaged Debentures

The First Mortgaged Debentures are those debentures that have a first claim on the property charged as regards the repayment of interest and principal at the time of winding up.

Second Mortgaged Debentures

Second Mortgaged Debentures are those debentures that are payable only after the redemption of the first mortgage debentures.

Differences between shares and debentures may be drawn in terms of differences between shareholders and debenture holders. The main differences are;

| S.No. | Point of Difference | Shareholders | Debenture holders |

| 1. | Status | Shareholders are the owners of the company. | Debenture holders are the creditors of the company. |

| 2. | Regularity of Returns | Shareholders get dividends on their holdings when there are sufficient profits. The rate of dividend is not fixed on equity shares. | Debenture holders are paid interest on debentures held by them. Interest on debentures is paid at a fixed rate at regular intervals. |

| 3. | Security | Shares are not secured. | Debentures are ordinarily secured. |

| 4. | Right to attend meetings | Shareholders are invited to attend the annual general meeting of the company. | Debenture holders do not have any right to attend any meeting unless any decision affecting their interest is taken. |

| 5. | Priority on Repayment | Share capital is not returned except in the case of preference shares and buy back of shares. In case of liquidation of the company, shareholders’ funds are refunded after the claims of all outsiders are settled. | Debentures being the loan is repaid by the company. Debenture holders have a right of priority of the refund of their loan over the shareholders. |

| 6. | Control | Shareholders control the affairs of the company. It is managed by the elected representatives of the shareholders called the Board of Directors. | Debenture holders are not involved in the management and control of the company. |

Methods of Issue of Debentures

The methods of issue of debentures may be discussed from the following viewpoint:

From the Point of View of Price of Issue

From the point of view of pricing of issue, the debentures, like shares may be issued at par, at a premium, and at discount:

At Par

Issue of debentures at par means the issue of debentures at face value. For example, if the face value of a debenture is Rs.100 and the same is issued at Rs.100, it means that the debentures have been issued at par.

At a Premium

Issue of debentures at a premium means the issue of debentures at a price higher than its face value. For example, if the face value of a debenture is Rs.100 and the same is issued at Rs.120, it means that the debentures have been issued at a premium, Rs. 20 is the amount of premium.

The amount of premium is credited to the Securities Premium Reserve account and is shown on the liabilities side of the balance sheet under the head “Reserves and Surpluses”.

At a Discount

Issue of debentures at a discount means the issue of debentures at a price lower than its face value. For example, if the face value of a debenture is Rs.100 and the same is issued at Rs.90, it means that the debentures have been issued at a discount, Rs.10 being the amount of discount.

Discount on issue of debentures is a capital loss and is shown under the line item ‘Other Non-Current Assets’ or ‘Other Current Assets’ depending upon the time period in which it is to be written off.

The discount on the issue of debentures can be written off either by debiting it to Statement of Profit and Loss or out of Securities Premium Reserve A/c, if any, during the lifetime of debentures.

Discount on issue of debentures to be written off within 12 months of the balance sheet date or the period of operating cycle is shown under ‘Other Current Assets’ and the part which is to be written off after 12 months of the balance sheet is shown under ‘Other Non- Current Assets’.

The Companies Act, 2013 does not impose any restrictions upon the issue of debentures at a discount.

From the Consideration Point of View

From the consideration point of view, the debentures may be issued for cash and for other than cash.

For Cash

Debentures may be issued for cash means collection of cash either in a lump sum or in installments against the issue of debentures. Hence, full consideration in cash may be received on the application in a single installment; or in the number of installments.

For other than Cash

Sometimes debentures may be issued for other than cash, i.e., in exchange of assets, or technology for their consideration.

Accounting Treatment on Issue of Debentures

Accounting treatment on issue of debentures when consideration is received in cash.

1. Full Consideration in Cash is Payable in Single Instalment on Application

Journal Entries

On receipt of money:

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Bank Dr. To Debentures A/c | Money Received | Money Received |

Questions: Sintex Ltd. issued 2,000, 8% debentures of Rs. 100 each at par, payable in full along with the application and all the debentures were subscribed. Pass necessary journal entries.

Solution:

Journal Entries in the books of Sintex Ltd

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Bank Dr. To 8% Debentures A/c (Being the issue of 2,000 8% debentures of Rs. 100 each and payment received in full along with the application as per Board’s Resolution No……. dated….) | 2,00,000 | 2,00,000 |

2. Issue of Debentures at a premium and full consideration in cash is payable in single instalment on application.

Journal Entries

On receipt of money:

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Bank Dr. To Debentures A/c To Securities Premium A/c | Money Received | Nominal value (Amount of premium) |

3. Issue of Debentures at a Discount and Cash is Payable in a Single Installment on Application

Journal Entries

On receipt of money:

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Bank Dr. Discount on Issue of Debentures A/c Dr. To Debentures A/c | Money Received (amount of discount) | Nominal value |

4. Full Consideration in Cash is Payable in Installments

On receipt of application money:

Journal Entries

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Bank Dr. To Debentures Application A/c | (application money received) | (application money received) |

On Allotment

Journal Entries

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Debentures Application A/c Dr. To Debentures A/c | (application money) | (application money) |

On making allotment money due

Journal Entries

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Debentures Allotment A/c Dr. To Debentures A/c | (allotment money due) | (Allotment money due) |

On receipt of allotment money:

Journal Entries

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Bank Dr. To Debentures Allotment A/c | (Allotment money received) | Allotment money received) |

On making call money due

Journal Entries

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Debenture Call A/c Dr. To Debentures A/c | (Call money due) | (Call money due) |

On receipt of call money

Journal Entries

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Bank Dr. To Debentures Call A/c | (call money received) | (call money received) |

5. Issue of Debentures at a premium and full consideration in cash is payable in installments

If debentures are issued at a premium and full consideration in cash is payable in installments, then such premium is generally collected along with allotment money. The journal entries, in this case, are passed at the time of making the allotment due as shown below:

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Debentures Allotment A/c Dr. To Debentures A/c To Securities Premium A/c | (Total money due) | (Allotment money due) (Premium money due) |

Issue of Debentures at a discount and consideration in cash is payable in installments:

If debentures are issued at a discount and the consideration in cash is payable in installments, then such discount is generally allowed in the allotment. The journal entries, in this case, are passed at the time of making the allotment money due as shown below:

| Date | Particulars | L.F. | Debit (Rs.) | Credit (Rs.) |

| —- | Debentures Allotment A/c Dr. Discount on Issue of Debentures A/c Dr. To Debentures A/c | (allotment money due) (amount of discount) | (total amount)) |