What is Bill of Lading?

A Bill of Lading B/L is a shipping document issued to the exporter or its bank by a common carrier that ships the goods. A carrier is a company or a person legally entitled to transport goods by land, water, and air.

Therefore, the B/L accepts the receipt of cargo given in the bill for shipment on board of the vessel. It is also an undertaking to deliver the goods in the same order and condition as obtained, to the consignee or his order provided that the freight and other charges specified in the B/L have been duly paid.

Table of Contents

- 1 What is Bill of Lading?

- 2 Functions of Bill of Lading (B/L)

- 3 Types of Bill of Lading (B/L)

- 3.1 Straight Bill of Lading (B/L)

- 3.2 Order Bill of Lading (B/L)

- 3.3 On Board or Shipped Bill of Lading (B/L)

- 3.4 Received for Shipment Bill of Lading (B/L)

- 3.5 Clean Bill of Lading (B/L)

- 3.6 Dirty (claused) Bill of Lading (B/L)

- 3.7 Stale Bill of Lading (B/L)

- 3.8 Trans-shipment Bill of Lading (B/L)

- 3.9 Through Bill of Lading (B/L)

- 3.10 House (or freight forwarders’) Bill of Lading (B/L)

- 3.11 Short forms/Blank Back Bill of Lading (B/L)

- 3.12 Charter party Bill of Lading (B/L)

- 4 Ocean (Marine) Bills of Lading (B/L)

- 5 Airway Bill of Lading (AWB)

The Bill of Lading (B/L) contains the following information:

- Shipping company’s name and address;

- Consignee’s name and address;

- Port of loading and port of discharge;

- Shipping marks and particulars;

- Number of packages;

- Shipped on board with date and rubber stamp;

- Description of packages and the goods;

- Gross weight and net weight;

- Freight details and name of the vessel;

- Signature of the shipping company’s agent

Bill of Lading (B/L): ‘Freight Paid’ or ‘Freight to Pay’

The B/L may be marked as ‘freight paid’ or ‘freight to pay’. If the freight is pre-paid by the exporter, the B/L is marked or stamped as ‘freight paid’ while in case the freight has not been paid, ‘freight to pay’ or ‘freight collect’ is marked on the B/L.

The B/L is issued by the shipping company in exchange for mate’s receipt. Therefore, the shipping company ensures that all the clauses appearing on the mate’s receipt are reproduced on the B/L prior to signing and issuing it.

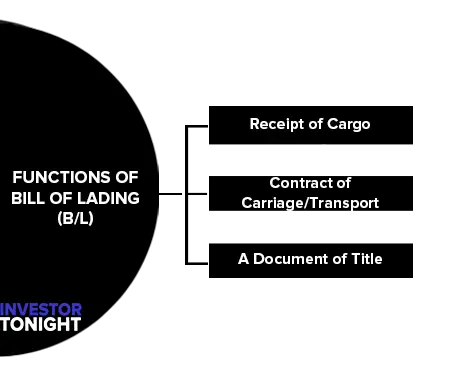

Functions of Bill of Lading (B/L)

Bill of Lading (B/L) serves three important functions:

Receipt of Cargo

It is a receipt acknowledging that the goods have been received by the carrier (i.e. a receipt of cargo by the shipping company).

Contract of Carriage/Transport

It is a contract binding the carrier to deliver the goods to the importer.

A Document of Title

The negotiable B/L, its most common form, is a document that establishes control over the goods

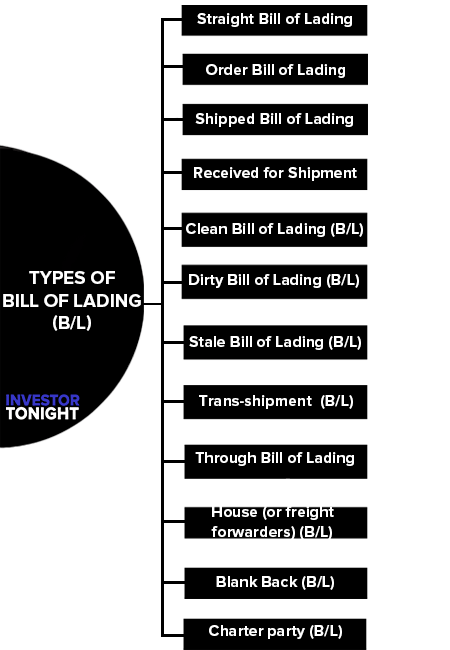

Types of Bill of Lading (B/L)

The various types of bill of lading are:

- Straight Bill of Lading (B/L)

- Order Bill of Lading (B/L)

- On Board or Shipped Bill of Lading (B/L)

- Received for Shipment Bill of Lading (B/L)

- Clean Bill of Lading (B/L)

- Dirty (claused) Bill of Lading (B/L)

- Stale Bill of Lading (B/L)

- Trans-shipment Bill of Lading (B/L)

- Through Bill of Lading (B/L)

- House (or freight forwarders’) Bill of Lading (B/L)

- Short forms/Blank Back Bill of Lading (B/L)

- Charter party Bill of Lading (B/L)

Straight Bill of Lading (B/L)

- It consigns the goods to a specific party, normally the importer, and is not negotiable.

- It is used where no financing is involved.

- It is not negotiable, not popularly used in export financing

Order Bill of Lading (B/L)

- The goods are consigned to the order of a named party, usually the importer.

- The exporter retains title to the goods until it endorses the B/L on the reverse side.

- The exporter’s representative may endorse to a specific party or endorse it in blank by simply signing his or her name.

- The carrier delivers the goods in the port of destination to the bearer of the endorsed order B/L, who must surrender it.

- It represents goods in transit that are readily marketable and fully insured, this document is generally considered to be good collateral by banks.

- It is required under letter of credit financing and for discounting of drafts.

On Board or Shipped Bill of Lading (B/L)

- It states that the goods have been placed “on board” the ship/carrier.

- It is required in case of FOB (i.e. Free On Board) shipments.

Received for Shipment Bill of Lading (B/L)

- It states that goods have been received by the shipping company pending for shipment and cargo is under custody of the carrier.

- It is required in case of FAS (i.e. Free Alongside Ship) shipments.

Clean Bill of Lading (B/L)

- It does not contain any negative remark on either the quality of goods or on the physical condition of package of the cargo received by the shipping company.

- In fact, all importers worldwide insist upon a clean bill of lading.

Dirty (claused) Bill of Lading (B/L)

- It contains any negative remark on either the quality of goods or on the physical condition of package of the cargo received by the shipping company.

- It is not accepted by most importers unless otherwise clearly given in the export contract.

Stale Bill of Lading (B/L)

- It is presented after the vessel has sailed and the goods have reached at the port of discharge before the bill of lading could reach the buyer.

- This may lead to delay in customs clearance of goods, payment of warehousing charges, and the risk of loss or damage to the cargo at destination.

- However, the issuing bank may issue the importer a guarantee for delivery of goods and a bond, both of which need to be countersigned by the issuing bank for getting the goods clearance through customs in absence of the bill of lading.

- However, the importer is required to surrender the correctly endorsed bill of lading upon its receipt or replace it in case of its loss.

Trans-shipment Bill of Lading (B/L)

- It is also issued when trans-shipment of cargo is required but the first carrier issuing the bill of lading acts as an agent in subsequent stages of voyage.

- The first carrier cannot be held liable for any loss or damage in the subsequent stages of transport by the holder of trans-shipment bill of lading.

- Importers generally prefer a through bill of lading.

Through Bill of Lading (B/L)

- It is issued where the goods are to be moved from one carrier to another.

- It is a form of combined transport document wherein the first carrier acts as the principal carrier and is responsible for the total voyage and is liable in the event of any loss or damage to the goods.

House (or freight forwarders’) Bill of Lading (B/L)

- It is issued by the freight forwarder, consolidator or non-vessel carrier (NVC).

- It is a non-negotiable document including the names, addresses of the parties and specific explanation of goods shipped.

Short forms/Blank Back Bill of Lading (B/L)

- It is needed when the terms of the shipping contract are not given in the original bill of lading.

- Unless specifically prohibited, banks accept short forms bill of lading

Charter party Bill of Lading (B/L)

- It is issued by the carrier or its agent in case of charter shipping.

- It is not accepted for L/C negotiation unless otherwise authorized in the letter of credit.

Ocean (Marine) Bills of Lading (B/L)

- It is a transport document issued by the shipping company to the shipper for accepting the goods for carriage of merchandise. The shipper (also known as a consignor) is a person or a company responsible for organising and transporting goods from one point to another.

- This document has attained unique importance in shipping – it is the document of title, which means that the legitimate holder of the document is entitled to claim ownership of the goods covered therein.

- Therefore, it would be impossible for the importer to get ownership of the cargo unless she/he surrenders a signed original B/L to the shipping company at destination.

- The B/L becomes a ‘negotiable’ document, through endorsing it, in which case the goods specified in it can be transferred from one party to another.

- The negotiability is produced in B/L by stating ‘to order’ B/L. An exporter should insist upon ‘to order’ B/L in which case any cargo would be released on presentation of an original of ‘to order’ B/L.

- However, the ‘consignee-named’ B/L is prepared in the name of specific party which cannot be negotiated (transferred).

- The consignee named B/L should be accepted by an exporter only in case she/he is confident of receiving timely payment as in case of either advance payment or an irrevocable letter of credit.

- If the B/L includes a trans-shipment clause, the carrier has the right to trans-ship even if the letter of credit prohibits trans-shipment.

Airway Bill of Lading (AWB)

- It is also called air consignment note or airway bill of lading.

- The airway bill is a receipt of goods and an evidence of contract of carriage but unlike ocean B/L, it is not a document of title and therefore, it is non-negotiable.

- The goods are consigned directly to the named consignee and are delivered to the consignee (i.e. the importer) without any further formality once the customs clearance is obtained at the destination.

- Therefore, it is risky to consign the goods directly to the importer unless the exporter has ensured receiving the payment of goods. Alternatively, the exporter may insist upon a provision in the letter of credit to consign the goods to a third party like the issuing bank or arrange for receiving the payment on cash on documents basis.