Preference shares may be defined as shares that provide their holders an entitlement to receive a dividend, but only up to a specific limit, which is usually a fixed amount every year. They may also give their holders a limited right to participate in any surplus in the event of a winding-up, should there be liquidation and sale of the company’s assets.

Table of Contents

Preference shares may also be redeemable on fixed terms or on terms dictated by the issuing company.

- A right to be paid a fixed amount of dividend or the amount of dividend, calculated at a fixed rate, e.g., 10% nominal value of shares and also.

- A right to be paid the amount of capital paid up as such shares in the event of winding up of the company.

The article’s share capital is the sum of the total of preference shares.

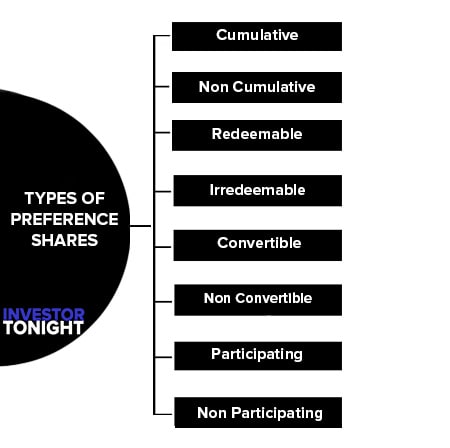

The different types of preference shares can be grouped as under:

- Cumulative Preference Shares

- Non Cumulative Preference Shares

- Redeemable Preference Shares

- Irredeemable Preference Shares

- Convertible Preference Shares

- Non Convertible Preference shares

- Participating Preference Shares

- Non Participating Preference Shares

As the name suggests, dividend payable on such preference shares is carried forward up to a specified period and paid only at the end of the specified period.

Unlike, cumulative preference shares, the dividend is paid to the shareholders of such preference shares every year and no arrear of dividend is carried over a period of time.

Redeemable preference shares are those preference shares that are to be paid back after the end of a specified period. It is important to note here that the Companies Act in India has prohibited companies to issue preference shares that are redeemable after the expiry of twenty years.

In other words, redeemable preference shares can be issued for a maximum period of twenty years. However, companies engaged in infrastructural projects can issue preference shares having a life of a maximum of thirty years subject to the condition that a minimum of 10% of the preference shares must be redeemed every year after the end of twenty years.

Irredeemable preference shares are those shares that cannot be redeemed during the whole lifetime of the company. In other words, such preference shareholders are paid back only at the time of liquidation of the company.

It is important to note here that prior to 1988, companies were permitted to issue both redeemable and irredeemable preference shares, but the Companies (Amendment) Act, 1988 imposed restrictions on companies to issue irredeemable preference shares, and thereafter companies are allowed to issue only redeemable preference shares.

Convertible preference shares are those preference shares that can be converted to equity shares after the expiry of a specified time period or as per the conditions laid down at the time of issue.

Contrary to the convertible preference shares, non-convertible preference shares cannot be converted into equity shares at any time during the life of the company.

Participating preference shareholders have the right to participate in the additional profits of the company left after paying the equity shareholders. The surplus dividend paid is in addition to the fixed amount of dividend paid to such shareholders.

Non Participating preference shareholders do not get the right to participate in the additional profits left after paying dividends to the equity shareholders of the company.