Redeemable Preference Shares ordinarily, the amounts received by the company on shares is not returned except on the winding up of the company. A company limited by shares, if authorized by its articles, may issue preference shares that are to be redeemed or repaid after a certain fixed period.

Table of Contents

Thus, the amounts received on such shares can be returned during the lifetime of the company. Such shares are termed redeemable preferences shares.

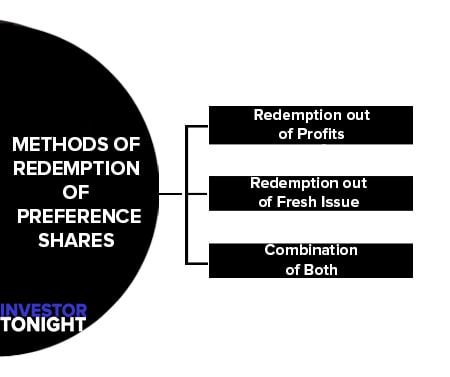

Based on the sources of funds for the purpose of redemption, the different methods of redemption of preference shares can be summed up as under:

Redemption out of Profits

This method is also called the capitalization of profit method as the distributable profit is utilized without making any change in the shareholding pattern of the company.

Since the amount of profits equal to the nominal value of preference shares redeemed is transferred to the CRR account which is equivalent to the paid-up share capital, the redemption of preference shares by this method does not affect the shareholding pattern of the company.

Redemption out of Fresh Issue

Under this method, the amount payable to preference shareholders is collected by issuing fresh shares. However, it is important to note here that the amount collected from fresh issue of shares cannot be utilized for paying premium amounts to the preferred shareholders.

In other words, the proceeds of fresh issue of shares can be utilized for paying back only the nominal value of the preference shares.

Combination of Both

Under this method, preference shares are redeemed out of profits as well as out of the proceeds of fresh issue of shares.

Following journal entries are passed in the books of accounts of the company for the redemption of preference shares:

When the preference shares are partly paid up, these are to be made fully paid up before redemption. The entry for making partly paid-up shares fully paid up.

| S.No. | Particulars | Rs. | Rs. |

| 1. | When the preference shares are partly paid up, these are to be made fully paid up before redemption. The entry for making partly paid-up shares fully paid up: For making call due- Preference Share Final Call a/c Dr. To Preference Share Capital a/c For receipt of call money- Bank a/c Dr. To Preference Share Capital a/c | — | — |

| 2. | When the preference shares are redeemed out of the proceeds of fresh issue of shares: For fresh issue of shares at par Bank a/c Dr. To Equity/ Preference Share Capital a/c For Fresh Issue of shares at a premium Bank a/c (with amount received) Dr. To Equity/Preference Share Capital a/c (with nominal value) To Securities Premium a/c (with premium amount) For fresh issue of shares at a discount Bank a/c (with amount received) Dr. Discount on Issue of Shares a/c (with discount) Dr. To Equity/ Preference share Capital a/c | — | — |

| 3. | When the preference shares are redeemed: For redemption at par a. Preference Share Capital a/c Dr. To Preference Shareholders a/c (For making the amount due) b. Preference Shareholders a/c Dr. To Bank a/c (For making payment) For Redemption at premiuma. Preference Share Capital a/c Dr. Premium on Redemption of Pref. Shares Dr. To Preference Shareholders a/c (For making the amount due) b. Preference Shareholders a/c Dr. To Bank a/c (For making payment) c. Securities Premium a/c Dr. or Statement of P/L Dr. To Premium on Redemption of Pref. Shares (For adjustment of premium on redemption) | — | — |

| 4. | When the shares are redeemed out of distributable profits-All the entries above entries except for entry no. 2 depending on whether the shares are redeemed at par or premium will be passed. In addition, the following entry will be passed for the redemption of preference shares out of profit: General Reserve a/c Dr. Statement of P/L Dr. To Capital redemption Reserve a/c (For transfer of nominal value of preference shares redeemed out of profits to Capital redemption Reserve Account) | — | — |