Real estate investment is a long-term investment and also it is a durable asset. The life of the building is much longer than any other asset. The realization of land and building takes much longer time because it involves complicated legal procedures and high transaction cost.

Table of Contents

Real estate assets are classified based on use into the following:

- Purchaser occupied property: The person who purchases the property for his own use either for his residence or for his business premises is called purchaser occupied property.

- Income producing property: The property purchased for the purposes of leasing or renting is called income generating property.

- Property developed for sale: If the purpose of purchasing the property is to sell to others for profit, it is called property developed for sale.

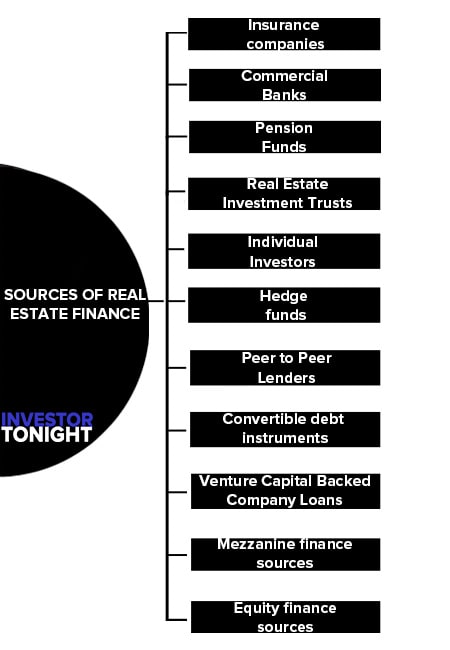

Sources of Real Estate Finance

More frequently, investors borrow from banks, life insurance companies, or other institutional lenders a substantial portion of the cost of real estate, and the debt will be secured by a mortgage creating a lien against the property. In some cases, the real estate may be acquired subject to existing debt, existing debt may be assumed in connection with the acquisition, or the seller may be willing to take back a lien position to secure a portion of the purchase price and perhaps repayment of existing financing.

The sources from which the finances are acquired include the following;

Conventional sources of financing

These finances can be advanced from the following sources;

- Insurance companies

- Commercial Banks

- Pension Funds

- Real Estate Investment Trusts (REITS)

- Individual Investors

Insurance companies

These companies play an important role as providers of capital for real estate from an equity standpoint. They typically do their lending through local correspondents. For their real estate investments, this normally means long-term commercial and industrial financing.

Commercial Banks

Commercial banks act as lenders for a multitude of loans. While they occasionally provide financing for permanent residential purchases, commercial banks` primary real estate activity involves short-term loans, particularly construction loans which are usually six months to three years and to a lesser extent home-improvement loans.

Most large commercial banks have a real estate loan department and their involvement in real estate is through this department. Some of the largest commercial banks are also directly involved in real estate financing through their trust departments, mortgage banking operations and real estate investment trusts.

Pension Funds

Pension funds are one of the sources available for financing real estate. Whereas these funds historically were invested in stocks and bonds, the recent growth of pension funds has meant new outlets had to be found for their investments. This growth, plus the favorable yield available through real estate investments, has resulted in active participation in financing real estate projects. Besides making mortgage loans, pension funds also own real estate.

Real Estate Investment Trusts (REITS)

Real estate investment trusts (REITs) are tax-advantaged investment vehicles that must follow strict guidelines to preserve their status. Some REITs invest in equity interests in real estate, while mortgage REITs make loans secured by real estate. The types and amounts of loans made by REITs are governed by the trust’s internal documents, and federal tax laws limit the way mortgage REITs can structure their loan transactions.

REITs pool the money of many investors for the purchase of the real estate, much as mutual funds do with stocks and bonds.

There are three types of REITs.

- An equity trust invests their assets in acquiring ownership in real estate. Their income is mainly derived from rental on the property.

- A mortgage trust invests in acquiring short-term or long-term mortgages. Their income is derived from the interest they obtain from their investment portfolio.

- A combination trust combines the features of both the equity trust and the mortgage trust. Their income comes from rentals, interest, and loan placement fees.

Individual Investors

There are a number of large investors located throughout Uganda who constantly lend money on real estate. These investors include individuals with available funds, groups of investors seeking mortgage ownership and large investment companies desiring to hold a diversified portfolio.

They deal both direct and through mortgage brokers. Additionally, many of these investors seek to take an equity position in real estate. It is thus possible to raise equity capital through syndication instead of relying solely on mortgage funds.

Unconventional sources of financing

Following are the unconventional finance sources:

- Hedge funds

- Convertible debt instruments

- Venture Capital Backed Company Loans

- Mezzanine finance sources

- Equity finance sources

Hedge funds

A hedge is an investment vehicle that pools capital from a number of investors and invests in securities and other instruments. They are generally distinct from mutual funds as their use of leverage is not capped by regulators and from private equity funds. Hedge funds may be aggressively managed or make use of derivatives and leverage in both domestic and international markets with the goal of generating high returns.

Peer to peer lenders

Peer-to-peer lenders may include family, friends and even strangers who are interested in one’s success. This can be done on formal or informal agreements. The benefit of this source is quick access to cash and the flexibility in the repayment requirements but usually, loans from friends may come with expectations of employment and free discounted services.

Convertible debt instruments

These are essentially asset backed up loans that require the real estate business owner to give up some future equity in the real estate such as future rents if the lender wishes to convert the debt to an equity position in the company. The benefit is that it’s less risky for the lender since it’s acquired on an already on going investment for activities such as refurbishment.

Venture Capital Backed Company Loans

This is a bank-based lending source although limited to a small group of qualifying companies and usually geographically concentrated in certain areas, has significant benefits for qualifying companies. This arrangement allows companies with previous backing from venture capital companies that have established relationships with certain banks to access bank lending based primarily on the bank’s reliance on the due diligence done by the previous venture capital companies.

Mezzanine finance sources

These are sources for individual project loans which normally have a second charge on the development or investment being acquired for. They are basically used in acquisitions based on leveraged buyouts in which all investors not least the mezzanine financier anticipate cashing out by taking the investment publicly again and refinancing thereafter the acquisition. Mezzanine finance sources include private investors, mutual funds, pension funds, insurance companies and banks.

Equity finance sources

Equity funds are wholly generated and owned by one and to which there is no attachment. The chief source of equity funds is savings and these savings arise out of that part of income of individual or corporate organization. Equity funds sources could be private or public. Private equity may be drawn from individuals or corporate savings, that is, retained earnings, assets stripping, for cash or revenue reserves of companies over a period of time and accumulated savings of individuals from employment and profits from business enterprises.

Other sources of private equity funds apart from savings include funds from family sources, friends and the thrift system. Public equity on the other hand is derived from an invitation extended to the public to subscribe to the equities/ownership of a real estate company set up for that purpose. Some examples of this are capital issues, equity warrant issues, securitization, and unitization

Funding Techniques for Real Estate Finance

This refers to ways of through which finances can be acquired for envisaging into a real estate investment whether development or redevelopment. Financing can be a very important component of investing in real estate.

In general, when investors desire to obtain financing, they usually pledge, or hypothecate, their ownership of real estate as a condition for obtaining loans. In many cases, investors also pledge personal property to obtain loans.

The major funding techniques are equity or debt financing techniques and these can be acquired depending on whether it’s a project-based development or corporate finance for development.

Equity and Debt Financing

Real estate financing typically involves a combination of debt and equity. It may involve more than one source of equity and more than one source of debt. The equity structure, as well as the debt, may take different forms through different entities.

In its simplest form, if a person were to acquire real estate for cash, without debt or borrowing of any kind, the value of the real estate would all be considered equity. At the other extreme, if a person acquired real estate by borrowing the entire purchase price of the property and pledging the real estate as collateral for the loan, the person would not have any equity in the property.

Equity Financing

This can be done for both development finance and investment finance. This is basically done through seeking additional finance form business owners, generating finance internally and other equity sources such as partners. It can also be through the use of shareholders’ funds either in the form of retained earnings from a company or by way of creating more shares in a company, which is known as a rights issue. A private limited company may consider a stock exchange or Alternative Securities Market floatation to generate equity funds.

As an alternative, shares may be placed privately rather than offered to existing shareholders through a rights issue. Warrants and options are also available. The former is created by a company inviting investors to subscribe for new shares in the company at some future date whereas the latter will be created by the existing shareholders. Unless the existing shareholder is the company seeking funds this type of disposal will only benefit the shareholder not the company.

Debt financing

This involves the raising of funds from banks and other lenders where the lender will benefit by interest charges and the repayment of capital. None of the equity in the company will pass to the lender although the assets of the borrower may provide collateral for the loan.

Finance may be obtained by way of debentures where the debt is secured against all or some of the company’s assets. Bonds are similar to government gilts but issued by companies. They offer the funder a higher return than debentures as they are not secured against assets. Some bonds, known as deep discount bonds, offer a very low rate of interest but maybe traded by the lender. They are therefore only attractive to lenders if the company is very likely to grow and be successful.

Benefits of Real Estate Investment

- There is tax exemption subject to certain conditions on profit (capital gain) arising from sale of land/buildings. This encourages investors to invest in real estate sector.

- Housing Loans are available at the lower rate of interest. Hence, middle-class people can easily purchase own house.

- Investment in commercial premises generates more rental income besides incredible increase in the value of the investment in premises.

- Yield of Investment in real estate is exorbitant whereas stock market investment is highly volatile. Hence, investors are more interested to invest in real estate.

Factors that make Real Estate Attractive

The real estate industry is attractive because:

- The demand of this industry is based on need

- It generates two types of income such as capital gain and rental income.

- It paves the way for regular income through lease/rent.

- The revolution in the real estate industry is due to arrival of MNCs especially in the IT sector. Therefore, the housing sector in India has witnessed strong development in the last few years.

Read More Articles