Most companies are usually started privately by their promoter(s). However, the promoters capital and the borrowings from banks and financial institutions may not be sufficient for setting up or running the business over a long term, especially when the business grows and looks to expand.

So companies invite the public to contribute towards the equity and issue shares to individual investors. The way to invite share capital from the public is through a “Public Issue”. Simply stated, a public issue is an offer to the public to subscribe to the share capital of a company.

Generally, equity shares are issued to the public to raise the capital required by a company. Once this is done, the company allots shares to the applicants as per the prescribed rules and regulations laid down by SEBI.

Table of Contents

Equity shares are the main source of finance of a firm. It is issued to the general public. Equity shareholders do not enjoy any preferential rights with regard to repayment of capital and dividend. They are entitled to residual income of the company, but they enjoy the right to control the affairs of the business and all the shareholders collectively are the owners of the company.

- They are permanent in nature.

- Equity shareholders are the actual owners of the company and they bear the highest risk.

- Equity shares are transferable, i.e. ownership of equity shares can be transferred with or without consideration to other person.

- Dividend payable to equity shareholders is an appropriation of profit.

- Equity shareholders do not get fixed rate of dividend.

- Equity shareholders have the right to control the affairs of the company.

- The liability of equity shareholders is limited to the extent of their investment.

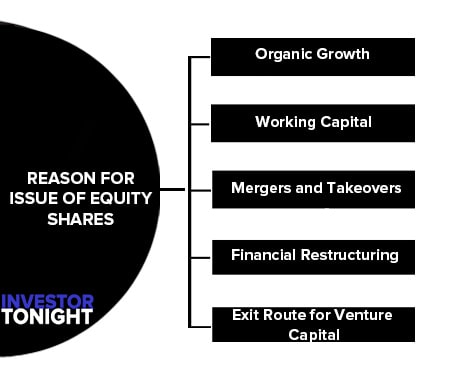

The equity shares are issued to raise equity capital. Following are the reasons for which equity capital is used:

Organic Growth

A company requires capital for expansion, entering into new market, and modernisation of business. In these cases, capital is required on a permanent basis. Equity capital is a long term source of finance which need not be paid back until the liquidation of the company. In short, to finance the organic growth of the company, equity capital is the best source of finance.

Working Capital

Working capital is used to finance the day to day activities of the business. It is the amount required on permanent basis to run day to day activities of the business. To finance permanent working capital, equity capital is the best source of finance.

Mergers and Takeovers

When there is merger and take over, purchase consideration involves payment of huge amount. In this case, equity capital is the best source of finance as it creates no financial burden to the company.

Financial Restructuring

When high cost debt borrowed creates problems to the company, capital restructuring becomes essential. Under this, debt burden is reduced either by repayment or by converting the debt into equity capital. Thus, equity capital helps the company to get rid of high cost debt.

Exit Route for Venture Capital

Venture capital is a risky capital which is invested in the early stage of a business involving high risk. It is provided by the Venture Capitalists. This capital is be repaid once the new business becomes profitable or after certain period of time. This is done by issuing equity shares to the public.

Equity shares are amongst the most important sources of capital and have certain advantages which are mentioned below:

- Equity shares are very liquid and can be easily sold in the capital market.

- In case of high profit, they get dividend at higher rate.

- Equity shareholders have the right to control the management of the company.

- The equity shareholders get benefit in two ways, yearly dividend and appreciation in the value of their investment.

- They are a permanent source of capital and as such; do not involve any repayment liability.

- They do not have any obligation regarding payment of dividend.

- Larger equity capital base increases the creditworthiness of the company among the creditors and investors.

- Equity shareholders get dividend only if there remains any profit after paying debenture interest, tax and preference dividend. Thus, getting dividend on equity shares is uncertain every year.

- Equity shareholders are scattered and unorganized, and hence they are unable to exercise any effective control over the affairs of the company.

- Equity shareholders bear the highest degree of risk of the company.

- Market price of equity shares fluctuate very widely which, in most occasions, erode the value of investment.

- Issue of fresh shares reduces the earnings of existing shareholders.

- Cost of equity is the highest among all the sources of finance.

- Payment of dividend on equity shares is not tax deductible expenditure.

- As compared to other sources of finance, issue of equity shares involves higher floatation expenses of brokerage, underwriting commission, etc.